Get the free letter of discontinuance

Show details

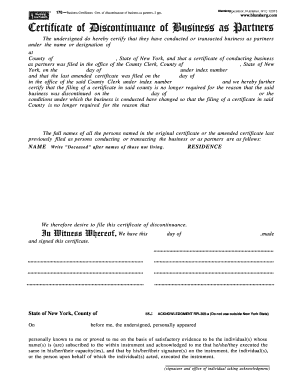

Reset Show Field Borders 341- Purchase Certificate of Discontinuance Business Conducted Under Assumed Name For Individual. 11-98 Click Here www.blumberg.com Certificate of Discontinuance of Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of discontinuance form

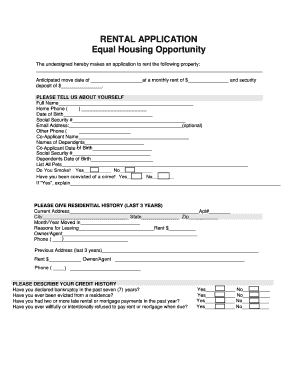

Edit your certificate of assumed name nyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of discontinuance of assumed name form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice of discontinuance online

To use our professional PDF editor, follow these steps:

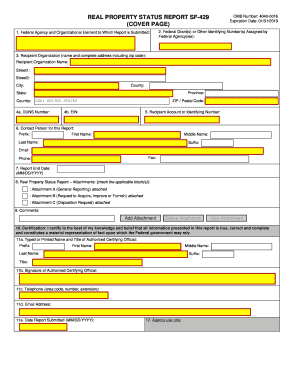

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new york business certificate pdf form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dba certificate ny form

How to fill out certificate of discontinuance:

01

Begin by opening the certificate of discontinuance form.

02

Fill in your personal information, including your name, address, and contact information.

03

Provide details about the case or matter for which you are filing the certificate of discontinuance, such as the court case number and the names of the parties involved.

04

Clearly state the reasons for discontinuing the case or matter, including any agreements or settlements reached between the parties.

05

Sign and date the certificate of discontinuance form, and make sure to include any necessary attachments or supporting documents.

06

Submit the completed form to the appropriate court or legal authority.

Who needs certificate of discontinuance:

01

Individuals or parties involved in a legal case or matter who have decided to discontinue or terminate the proceedings.

02

This may include plaintiffs, defendants, or their respective legal representatives.

03

The certificate of discontinuance serves as official documentation that the case or matter has been voluntarily withdrawn or resolved.

Fill

assumed name certificate new york

: Try Risk Free

People Also Ask about certificate of discontinuance of business

How much does it cost to register an S Corp in NY?

For S-corporations, the FDM tax is based on the corporation's New York State receipts and is as follows: $25 – Receipts not exceeding $100,000. $50 – Receipts exceeding $100,000 but not more than $250,000. $175 – Receipts exceeding $250,000 but not more than $500,000.

Does a DBA expire in NY?

In New York State, DBAs have no expiration date and renewals aren't necessary. You do, however, need to file a Certificate of Discontinuance if you're no longer conducting business.

How do I file an S Corp in New York?

There are ten steps you'll complete to start an S Corp in New York. Step 1: Choose a Business Name. Step 2: Obtain EIN. Step 3: Certificate of Incorporation. Step 4: Registered Agent. Step 5: Corporate Bylaws. Step 6: Directors and Meeting Requirements. Step 7: Stock Requirements. Step 8: Biennial Statement.

How do I change my DBA name in NY?

Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

How do I remove a DBA in NY?

Complete and file a Request for Cancellation of Reservation of Name with the Department of State. The filing receipt entitled “Certificate of Reservation” issued by the New York Department of State must accompany the request to cancel the name reservation.

How do I remove a DBA from NYS?

Complete and file a Request for Cancellation of Reservation of Name with the Department of State. The filing receipt entitled “Certificate of Reservation” issued by the New York Department of State must accompany the request to cancel the name reservation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new york business certificate without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including assumed name, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in assumed name certificate example without leaving Chrome?

certificate of assumed name can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete certificate of assumed name ny on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your certificate of assumed name new york. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is certificate of discontinuance of?

A certificate of discontinuance is a legal document filed to formally terminate or discontinue a business entity's existence or a specific legal proceeding.

Who is required to file certificate of discontinuance of?

Typically, the owners or authorized representatives of a business entity are required to file a certificate of discontinuance when they decide to dissolve the entity.

How to fill out certificate of discontinuance of?

To fill out a certificate of discontinuance, you must provide information such as the entity's name, the reason for discontinuance, the effective date of termination, and signatures of the authorized persons.

What is the purpose of certificate of discontinuance of?

The purpose of a certificate of discontinuance is to officially notify the state and public that a business or legal proceeding has been dissolved or terminated.

What information must be reported on certificate of discontinuance of?

The information that must be reported includes the name of the entity, the date of dissolution, the reason for discontinuance, and any relevant contact information.

Fill out your letter of discontinuance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dba Cancellation Form California is not the form you're looking for?Search for another form here.

Keywords relevant to discontinuance letter

Related to discontinuance form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.